- News

- Business News

- India Business News

- Big fat Indian wedding drives $130 billion industry, average spend/nuptial at Rs 12.5 lakhs

Trending

Big fat Indian wedding drives $130 billion industry, average spend/nuptial at Rs 12.5 lakhs

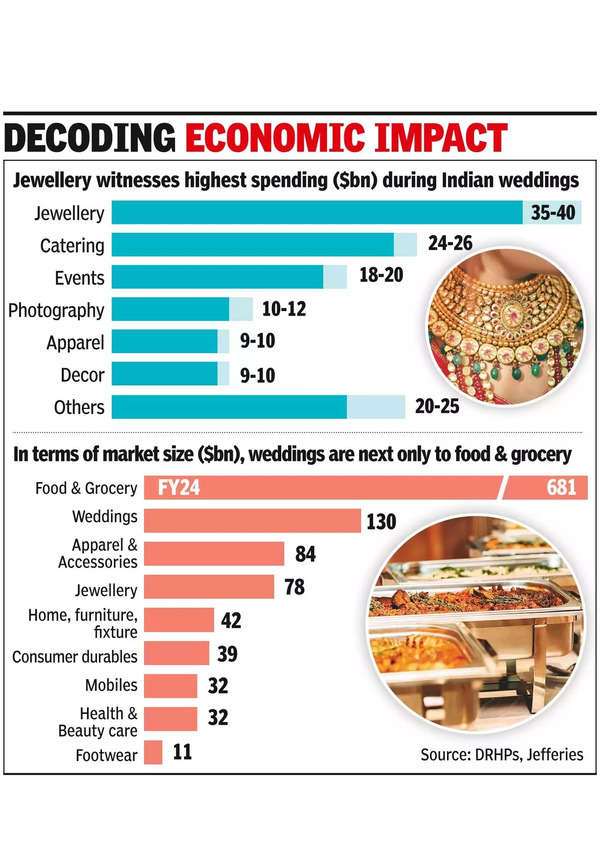

The Indian wedding industry, valued at $130 billion, is the second largest in India after food and grocery. A new report by Jefferies highlights the significant economic impact of Indian weddings, which are twice the size of the US market and a key growth driver for various sectors. It estimated that the average expenditure on a wedding is around $15,000, or Rs 12.5 lakh, and an average Indian couple spends approximately twice on weddings compared to education (pre-primary to graduation).

NEW DELHI: The Indian wedding industry at $130 billion ranks second only to food and grocery, and is a significant driver of discretionary consumption, says a new report, highlighting the enormous economic impact of the event across sectors.

The Indian wedding market is twice the size of the US market but smaller than China, said the report by investment banking and capital market firm Jefferies.The overall size of the industry was based on various available numbers and the report was prepared after visiting various hubs that cater to the industry.

It estimated that the average expenditure on a wedding is around $15,000, or Rs 12.5 lakh, and an average Indian couple spends approximately twice on weddings compared to education (pre-primary to graduation) - a sharp contrast to countries such as the US, where the spend is less than half that of education.

The numbers suggest that the average spend on a wedding is around five times India's per capita GDP of $2,900 (over Rs 2.4 lakh) and more than three times the average annual household income of around Rs 4 lakh. India's wedding spend to GDP ratio of 5 times is significantly higher than several other countries, the report added.

Weddings key growth driver for several sectors: Report

At anywhere between Rs 20 lakh and Rs 30 lakh, ‘luxury weddings’ see much higher spending than average with the upper end being much more lavish.

“This budget encompasses expenses for hosting five to six functions/events, luxurious accommodations at top-tier hotels, lavish catering, decor, and entertainment (expenses related to jewellery, wedding attire, and airfare are not included in these estimates),” the report noted. The uber rich have many more events, including lavish pre-wedding events and cruises thrown in.

As a result, the report, a rare attempt to capture the size of the industry and its impact across sectors, said that given the size and scale, Indian weddings are a key growth driver for several categories such as jewellery, apparel, catering, stay and travel, among other sectors. Over half the jewellery industry revenues are led by bridal jewellery while more than 10% of all apparel spends are driven by weddings and celebrations wear.

Wedding jewellery accounts for the largest proportion of the spend, accounting for nearly a quarter, followed by catering at 20% and events at 15%.

“Service providers to the wedding industry largely fall in the unorganised and highly fragmented category, consisting of many small-scale businesses and individual service providers who cater to both low- and high-spenders. This is partly due to the extreme divergence in regional preferences, which means smaller and regional players are better placed in addressing consumer needs,” said the report.

PM Modi had given a call last year to ‘wed in India’, urging people to go for destinations within the country rather than foreign countries as several celebrities and high net worth individuals were opting for destination weddings overseas.

The Indian wedding market is twice the size of the US market but smaller than China, said the report by investment banking and capital market firm Jefferies.The overall size of the industry was based on various available numbers and the report was prepared after visiting various hubs that cater to the industry.

It estimated that the average expenditure on a wedding is around $15,000, or Rs 12.5 lakh, and an average Indian couple spends approximately twice on weddings compared to education (pre-primary to graduation) - a sharp contrast to countries such as the US, where the spend is less than half that of education.

The numbers suggest that the average spend on a wedding is around five times India's per capita GDP of $2,900 (over Rs 2.4 lakh) and more than three times the average annual household income of around Rs 4 lakh. India's wedding spend to GDP ratio of 5 times is significantly higher than several other countries, the report added.

Weddings key growth driver for several sectors: Report

At anywhere between Rs 20 lakh and Rs 30 lakh, ‘luxury weddings’ see much higher spending than average with the upper end being much more lavish.

“This budget encompasses expenses for hosting five to six functions/events, luxurious accommodations at top-tier hotels, lavish catering, decor, and entertainment (expenses related to jewellery, wedding attire, and airfare are not included in these estimates),” the report noted. The uber rich have many more events, including lavish pre-wedding events and cruises thrown in.

As a result, the report, a rare attempt to capture the size of the industry and its impact across sectors, said that given the size and scale, Indian weddings are a key growth driver for several categories such as jewellery, apparel, catering, stay and travel, among other sectors. Over half the jewellery industry revenues are led by bridal jewellery while more than 10% of all apparel spends are driven by weddings and celebrations wear.

Wedding jewellery accounts for the largest proportion of the spend, accounting for nearly a quarter, followed by catering at 20% and events at 15%.

“Service providers to the wedding industry largely fall in the unorganised and highly fragmented category, consisting of many small-scale businesses and individual service providers who cater to both low- and high-spenders. This is partly due to the extreme divergence in regional preferences, which means smaller and regional players are better placed in addressing consumer needs,” said the report.

PM Modi had given a call last year to ‘wed in India’, urging people to go for destinations within the country rather than foreign countries as several celebrities and high net worth individuals were opting for destination weddings overseas.

End of Article

FOLLOW US ON SOCIAL MEDIA