- News

- Business News

- India Business News

- Standard deduction may rise under new tax regime

Trending

Standard deduction may rise under new tax regime

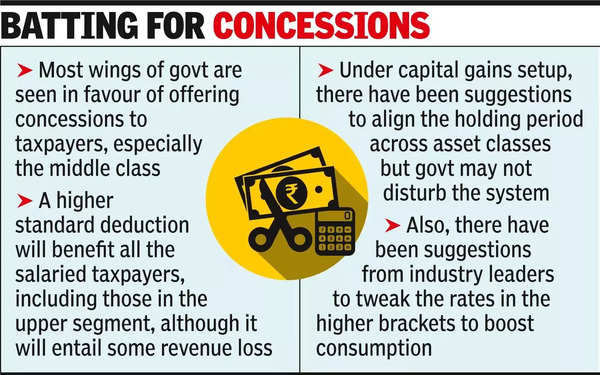

The finance ministry is exploring raising the standard deduction for income taxpayers. The NDA govt is cautious about changing the capital gains mechanism. Discussions for the Budget are underway with finance minister Nirmala Sitharaman. The overall mood indicates that most wings of govt are in favour of offering concessions to taxpayers, especially the middle class.

NEW DELHI: The finance ministry is assessing the possibility of raising the standard deduction limit for income taxpayers under the new regime, without tinkering with the exemption-laced older regime.

Besides, as the NDA govt readies to present its first Budget of its third term, it is unlikely to undertake major tweaks in capital gains mechanism, an issue on which the income tax department has been seeking a review.There have been suggestions to align the holding period across asset classes but govt may not be inclined to disturb the system, at least for the moment.

While discussions on the contours of the Budget have just begun with finance minister Nirmala Sitharaman undertaking public consultations, most of the exercise is currently limited to the finance ministry and internal assessment is being undertaken on multiple issues some of which will be discussed with other wings of govt before the finance ministry takes a final call, based on feedback from the PMO.

In the 2023 Budget, FM had introduced a standard deduction of Rs 50,000 for salaried taxpayers and those who earn pension under the new tax regime, which became the default option, unless you opted out. Also, rebate under Section 87A was increased under the new tax regime for taxable incomes not exceeding Rs 7 lakh, allowing those earning up to this level (taxable income) to not pay any tax under the new regime. The highest surcharge under the new regime was also removed.

Currently, individuals with a taxable income of upwards of Rs 3 lakh have to pay 5% income tax and there have been suggestions from industry leaders to tweak the rates in the higher brackets to boost consumption. A higher standard deduction will benefit all the salaried taxpayers, including those in the upper segment although it will entail some revenue loss.

Besides, as the NDA govt readies to present its first Budget of its third term, it is unlikely to undertake major tweaks in capital gains mechanism, an issue on which the income tax department has been seeking a review.There have been suggestions to align the holding period across asset classes but govt may not be inclined to disturb the system, at least for the moment.

While discussions on the contours of the Budget have just begun with finance minister Nirmala Sitharaman undertaking public consultations, most of the exercise is currently limited to the finance ministry and internal assessment is being undertaken on multiple issues some of which will be discussed with other wings of govt before the finance ministry takes a final call, based on feedback from the PMO.

The overall mood indicates that most wings of govt are in favour of offering concessions to taxpayers, especially the middle class, which has been a supporter of the Modi regime but is increasingly raising questions about the returns it gets for the tax it pays, be it through public healthcare or education.

In the 2023 Budget, FM had introduced a standard deduction of Rs 50,000 for salaried taxpayers and those who earn pension under the new tax regime, which became the default option, unless you opted out. Also, rebate under Section 87A was increased under the new tax regime for taxable incomes not exceeding Rs 7 lakh, allowing those earning up to this level (taxable income) to not pay any tax under the new regime. The highest surcharge under the new regime was also removed.

Currently, individuals with a taxable income of upwards of Rs 3 lakh have to pay 5% income tax and there have been suggestions from industry leaders to tweak the rates in the higher brackets to boost consumption. A higher standard deduction will benefit all the salaried taxpayers, including those in the upper segment although it will entail some revenue loss.

End of Article

FOLLOW US ON SOCIAL MEDIA